As A Teen, I Started Investing And Lost $8K. Here Are My Strategies After Years Of Error.

My strategies for investing

The day I turned 18, I opened my first brokerage account. As a kid, I wanted to get rich fast. As much as I’d like to think that I’m different from the other baby traders who traded aggressively and recklessly, I ended up following in their foot steps and lost $8,000 in three weeks. To top it off, I was investing using money I borrowed from my ex!

I’ve come a long way since then. Through trial and error, I managed to make sizable profits through the lessons I’ve learnt.

Eggs are great but don’t put them in a single basket

We’ve all heard this before, what does it really mean? My utmost straightforward definition to this is to not invest in the same industries or rather, in companies of industries that share low or negative correlations. For example, even though I love travelling, I wouldn’t pour all my funds into air travel companies in different countries. A wave of pandemic will send my stocks into all-reds and negatives.

What I would do instead is to blend different investments in my portfolio. This means researching thoroughly and investing in a handful of companies I trust or even use regularly.

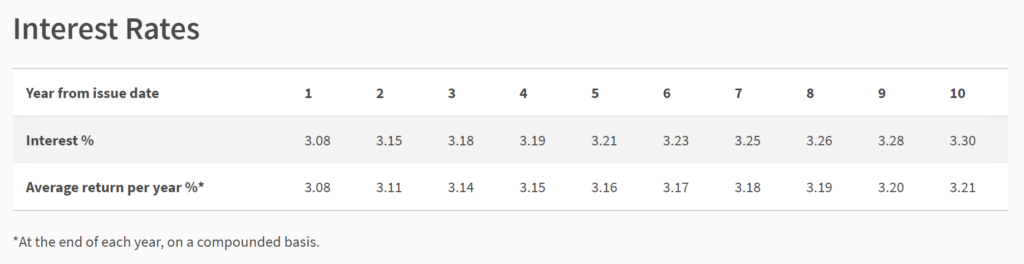

When in doubt, start with Singapore Savings Bonds (SSBs)

SSBs are common in many portfolios for good reason. They have consistently given me higher returns of about 2-3% p.a compared to banks’ fixed deposits. I would recommend these bonds to baby investors as they carry little risk and you can withdraw the funds unlike fixed deposits.

To do so, you’ll need a bank account with any local bank and a Central Depository (CDP) account that’s linked to the bank account, and apply for the bond either via an ATM or Internet Banking.

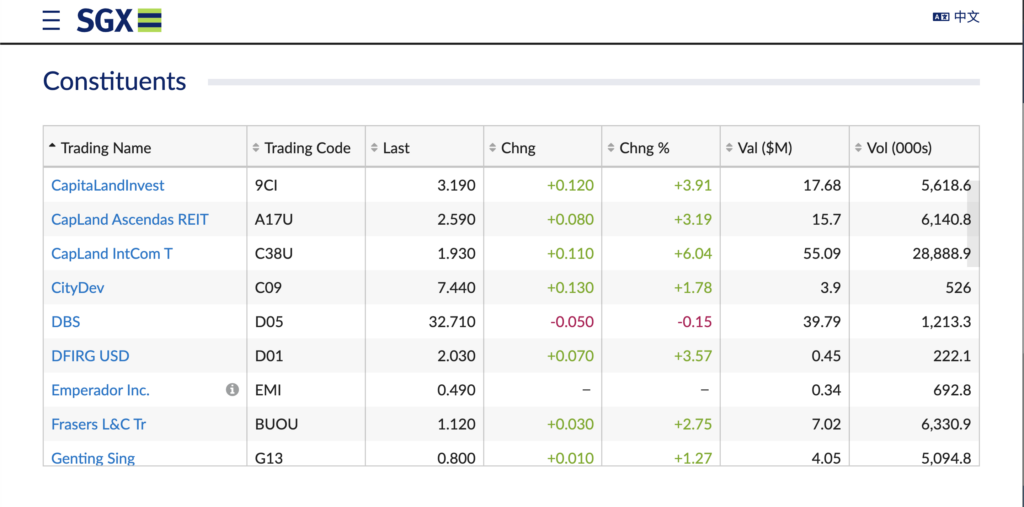

There’s only one STI you need in your life

I remember the very first time I got into trading, I did not know what to buy into. The sheer number of stocks to pick from is both a blessing and curse. That’s why I I use The Straits Times Index (STI) to see the best performing ones. These are stocks that have stable and decent year-on-year growth. Once I grew more adventurous, you can refer to other international stock screeners to see what’s worth your buck!

Spread your wealth, not legs

DCA, or rather, dollar cost averaging, is a term commonly thrown by investors. It might sound complicated but what it really means is putting aside cash to invest a fixed amount at regular intervals. This could be monthly, quarterly or even twice a year. I personally stick to two times a month, given how the stock market is now generally volatile after the pandemic.

What does this do, you may ask? DCA helps mitigate timing risk. We all know that the price of stocks fluctuate all the time. buying at different intervals regularly, we reduce price volatility because you will purchase more shares at lower prices and fewer shares at higher prices.

Getting into online brokers

Getting into stocks via brokerage companies without proper research was one of my steepest dips. Given stocks’ high volatility, it’s key to know when to hold or fold them. In not being careful, my decision was to invest in penny stocks, pouring in a few thousands of dollars which was a lot of young adult, only for the whole market to go up in reds.

I invested blindly and burnt my fingers—every single one of them—in the stock market.

What that looked like was a baby trader, keen to capitalise on potential market growth, losing all his capital within the span of a few days. This is exactly why greed is deadly, and the reason why you have to plan and properly execute your exit strategies. In the past, this was done via manual monitoring which could arguably be dangerous because of time sensitivity.

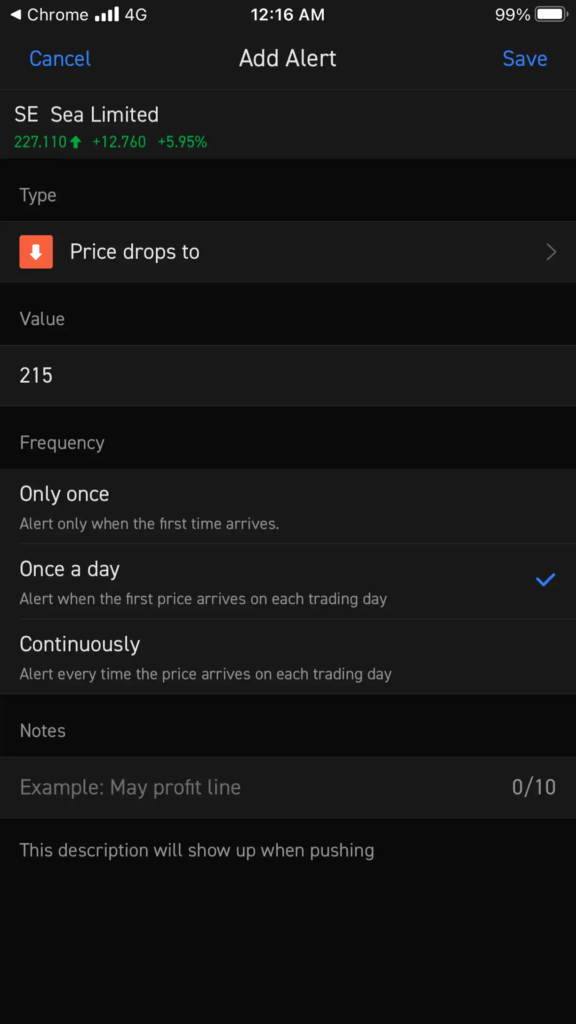

Now, we have online brokers like Moomoo with in-app stock alerts which allows you to manage a portfolio, from timing a market entry to exiting without having to track the individual stocks.

This worked out for me, especially since I could put in alerts for different price rises and drops. It could as little as once a day, to as many times as the stock price arrives every other day. This means proper monitoring and no more human error in trading.

So remember, set your alerts and be patient. The stock market is a device for transferring money from the impatient to the patient.

When is a good time to start investing?

Trading and investing is a lot of work, especially if you’re a teen. Starting early means you’re likely to make more mistakes which isn’t necessarily a bad thing. There are several types of investments that I’ve yet talked about too, but one’s preference isn’t universal and I would suggest looking into digital trading apps online, or start with robo-advisors and slowly work toward what you feel you like most. You will learn and discover a long-term plan that works best for you.