My Partner And I Are Both Still Interns But We’re Buying Our First House. Here’s How We Save Money.

Buying a first house as a young couple

My boyfriend and I are both turning 25 soon, and we’re starting to look for our future home. The thing is, we’re both still interns which means our finances aren’t as good as they need to be. Even though I really want a house where we can happily settle down, I am terrified of the entire process. How much time will it take? Do we even have enough money to start? Fortunately, my boyfriend is financially savvier than me. “It won’t be that difficult if we do it together,” he said. It’ll be a lot of fun!” When I first started researching BTO or resale flats, I was perplexed about how much money I needed to save. As a result, I decided to write this article to assist young couples who are buying their first house.

Adulting is difficult. Here’s what my boyfriend and I are doing to boost our finances.

Proper Financial Planning

My boyfriend and I are both very organised people. Whenever we plan an event or a date, we always write it down to the smallest detail. So when it comes to buying our future home, naturally, we’re even more meticulous.

We did our research to find out the average amount needed to get a house. This is so that we can have a savings target. Doing this allows us to better allocate our funds so that we buy things that we really need and can afford. After all, paying for a house won’t be our sole financial obligation in the future.

Planning our finances helps us know how much money we can put aside for:

- Student loans

- Parents

- Bills (phone, utility etc)

- Daily expenses

- Wedding

- Registering for a marriage certificate

- House

- Renovation

- Property tax

- Home furnishing and household items

- Service and conservancy charges

- Personal and home insurance

- Emergency fund

Having these values allows us to prioritise our true needs. As a result, we’ve become much more financially efficient and our bank accounts have seen an improvement in numbers.

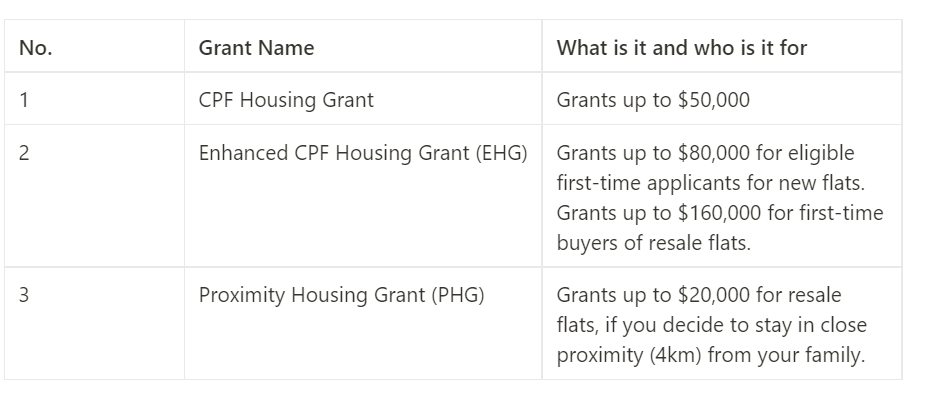

Maximising All Of Singapore’s Housing Grants

We researched all of the available grants and recorded them in our “future planning notebook.” My boyfriend and I decided to make use of all these grants to offset the cost of our house. Here are some grants that may be of assistance to first-time home buyers.

We calculated and discovered that we can receive approximately $80,000 in grants if we obtain a BTO flat and $220,000 in grants if we obtain a resale flat. This will undoubtedly help us save money on the house. The average cost of a five-room flat in Singapore is $500k++ to $600k++. Therefore, having the grants helps us cut 26% of the price of the flat, which is a lot.

Building An Emergency First House Fund

My boyfriend and I decided to have an emergency fund because we can never really pinpoint the exact amount we need to get a house. We might even end up paying more because of:

- Rising interest rates

- Decrease in monthly CPF contributions if we change jobs

- CPF withdrawal/valuation limit has been reached

Therefore, we got a shared bank account to put our emergency fund into. My boyfriend is a very responsible person, so I trust him with the account. We also have a shared Google Sheets doc which we’ll update every time a deposit and a withdrawal is made.

I’m currently working part-time in the F&B sector while juggling my internship. My boyfriend is also working part-time and freelancing for various companies. Even though it might seem like we work more than we meet, we always remind ourselves that it’s for our future dream home.

We are planning to get a five-room BTO flat. Both of us decided to set aside $1,000 each month to save up for our house and wedding, which is 28% of our combined salary. While it is tempting to go all out and splurge on your dream home, remember that the more you spend, the less savings you will have for your future needs.

Once your emergency fund has reached the appropriate size, you will have more leeway to begin saving and investing for mid- to long-term goals. Until then, prioritise saving money so you can have a financially independent future.

Using Investment Platforms

Because I am not a big risk taker, I usually put my money in investment platforms such as Singlife and Syfe. I usually invest 15% to 20% of my salary in each of these platforms. Having money outside of my bank account makes it easier for me to spend less. Despite the fact that both these platforms allow you to transfer money back to your bank account whenever you want. Singlife offers up to 3% p.a. on your first $10,000, while Syfe offers 2.3% p.a. My boyfriend, on the other hand, invests in higher-risk portfolios such as Syfe’s REITs and Core Equity100.

Being More Frugal

We know that the longer we wait to get a house, the higher the price of the house will be when we want to purchase it. Therefore, we decided to be as frugal as possible but not till the point where we can only eat white bread every day.

As someone who’s addicted to using Grab and GrabFood, I promised myself and my partner that I will stop doing so because I realised that I’ve been spending way too much money on them. The money that I spent could have been used to fund our house and future together. So, I’ve stopped using Grab that often.

Both of us also decided to get concessions for our transport cards because we usually spend $150 a month on transport because we travel a lot for school and work. Doing so helped us save $60 a month. We’ve also set a budget of $50 on dates so we won’t overspend.

Even though all these might seem like small savings, when compounded, it helps us save a lot of money.

Doing Side Hustles

We decided to start a side hustle together and make use of both our talents. My boyfriend is a 3D artist and designer while I’m a media student and photographer. We decided to create our own clothing brand that is currently in the works.

We’ve always wanted to have a side business together ever since we were in secondary school but didn’t have the right people to do it with. Therefore, we decided to do it together. Despite our busy schedules, we will always find time to meet in person or online to discuss designs and other business related stuff. Having a side hustle helps us earn side income which allows us to save more money for our future home.

Start saving early for your first house

I only realised the importance of saving money when I was in polytechnic. While this epiphany didn’t come too late, I sometimes wished our education system would inculcate such values so that my peers can start building a nest of funds early on in their lives. That’s why I’m definitely teaching my kids to save as early as they are in kindergarten.

I’m an intern who’s starting up for her dream home, and this is my story. Now tell me yours!

I have read your article carefully and I agree with you very much. This has provided a great help for my thesis writing, and I will seriously improve it. However, I don’t know much about a certain place. Can you help me?